Bank Greenwashing: Website Edition

Updated December 4, 2023 by Neil Simpson

Photo by Alena Koval from [Pexels]

Our banks are under increasing pressure to take action on climate change. This crisis is fiendishly complicated, but for a bank's marketing department, it's fiendishly marvellous: "We financed seven wind turbines this year. Our customers will love that." Environmentally-friendly policies and activities are marketing gold for banks and the messaging is slick.

But what if positive policies are dwarfed by negative activities that aren't mentioned? Then the bank is not only negating the action it's taking to mitigate climate change, but it's falsely soothing customer concerns to clear the way for business as usual. Welcome to the hot-air-fuelled world of greenwashing, where dirty laundry gets spun until it's technicoloured.

This is the first in a series on banks and greenwashing, during which we'll be sharing examples of misleading - alongside legitimate - messaging, to help you make better-informed financial decisions.

Over-simplistic and vague messaging

Sound the alarm, there's a jargon wave approaching. Our vocabularies are evolving to grapple with the climate crisis, from 'net zero' and 'green transition', to 'carbon sink' and 'sequestration'. This is necessary progress, but it also provides more opportunities to talk the talk, without walking the walk.

When it comes to the talk, HSBC is a pro. The bank has a prominent section on its website called "Our climate strategy". At the top, HSBC states that it is "committed to the transition to a global net zero economy - not just by playing our part, but by helping to lead it".

HSBC's Website [source]

Next is a colourful slideshow of coral reefs, solar panels, forests, and environmentally friendly statements, including "We're financing the transition to a net zero world" and "We're funding greener, more sustainable cities".

HSBC's Website [source]

We don't contest these statements. Apart from anything else, if HSBC was not doing these things, it would be setting itself up for an unnecessary scandal; HSBC probably is providing financing for net-zero enterprises and environmentally sustainable projects. What we do contest however, is whether or not these statements paint a complete picture of HSBC's financing activities.

In 2021, research conducted by the Rainforest Action Network (RAN) and published in its annual report, Banking on Climate Chaos, revealed that during the preceding 12 months, HSBC provided $23.542 billion USD in financing for companies involved in some part of the fossil fuels life cycle. When you zoom out to the period covering 2016-2020, that figure climbs to $110.745 billion USD. RAN found that HSBC’s financing of fossil fuel expansion is following a sharp upward trend, from $6.458 billion USD in 2016, to $16.170 billion USD in 2020.

It is doubtful that HSBC went from $23.542 billion USD to $0 USD for fossil fuels financing between the end of 2020 and the publication of this article. So let's assume that HSBC is currently providing billions in financing for fossil fuels, while also being "committed to a net zero future". That level of financing annihilates HSBC's alleged commitment.

HSBC is picking and choosing which of its financing activities to present to its customers, which is misleading, to say the least. For example, HSBC is currently financing tar sands oil extraction via the Line 3 pipeline expansion. They don't have a colourful slideshow for that.

Distraction action

If you're not proud of something you're doing, a time-honored tactic is to talk loudly and at length about something else that you are proud of instead. Many banks don't want to talk about the planet-wrecking activities they finance; instead, a bank will create a distraction by talking about the sustainable way in which its internal business is run. The buzzword of choice? "Sustainability".

JP Morgan Chase & Co dives straight into the murky waters of sustainability on its website:

JP Morgan Chase & Co's Website [source]

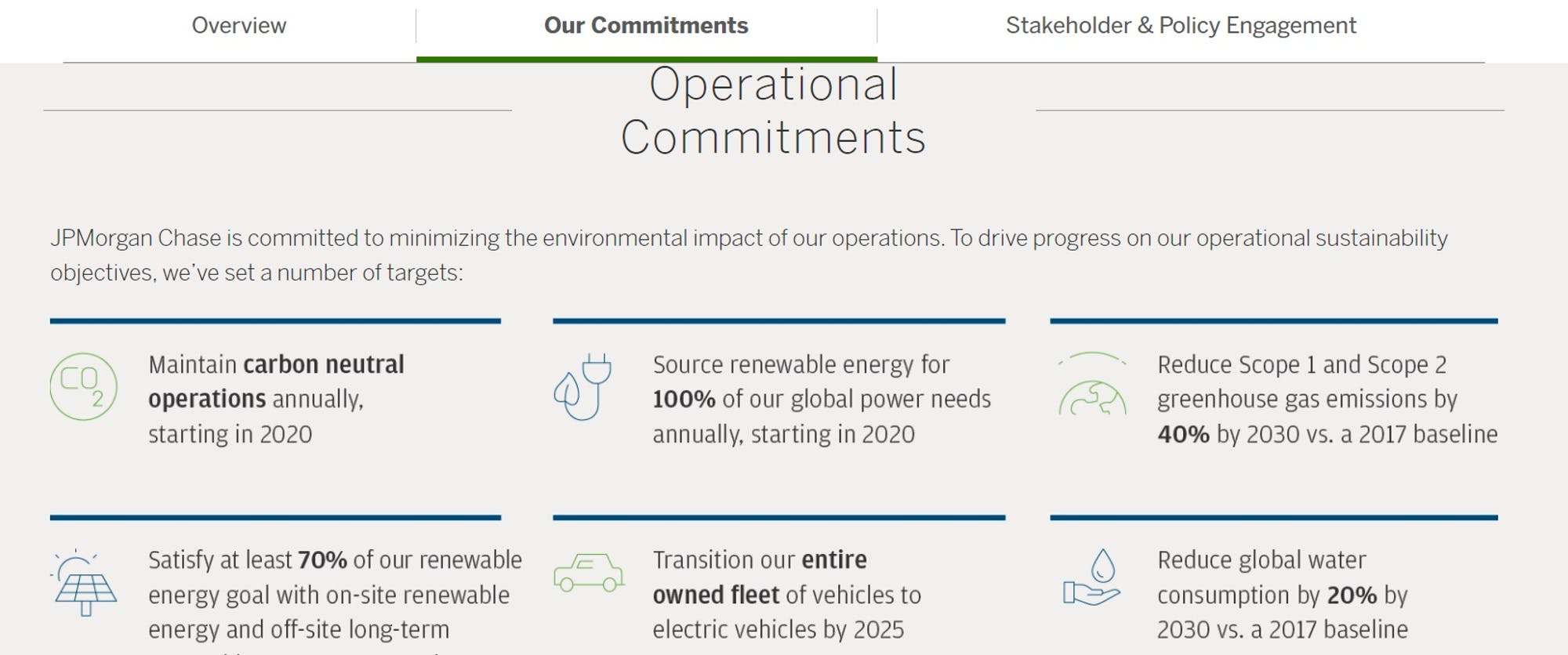

Scrolling down this page takes you to a section labelled Operational Commitments. It states that all of JP Morgan Chase's offices run on renewable energy, which is excellent. It will only own electric vehicles by 2025. Well done, JP Morgan Chase. There's even direct references to its greenhouse gas (GHG) emissions, but not all of them: "Scope 1" and "Scope 2" is carbon accounting jargon for "internal business operations only".

JP Morgan Chase & Co's Website [source]

- Scope 1: Any GHGs emitted from a source that is directly owned or controlled by an organization

undefined - Scope 2: Any GHGs emitted in order to supply the energy that an organization needs to operate

undefined - Scope 3: Any GHGs emitted by a customer or beneficiary of an organization

undefined

As pointed out by the United States Environmental Protection Agency, "Scope 3 emissions, also referred to as value chain emissions, often represent the majority of an organization’s total GHG emissions." This is why most banks will be forthcoming in talking to customers about Scope 1 and Scope 2 emissions, but not Scope 3.

This distraction tactic is exemplified by JP Morgan Chase. Its Scope 1 and 2 emissions are shrinking as it moves to electric-only company vehicles and renewable sources for its direct energy needs. JP Morgan Chase's Scope 3 emissions however, include those resulting from its provision of $316.7 billion USD in financing for the fossil fuels industry between 2016 and 2020. This is not on JP Morgan Chase's sustainability webpage.

After all that explanation of Scope 1, 2, and 3 emissions, you've probably forgotten that JP Morgan Chase hasn't revealed exactly what it finances with its customers' money. Funny that.

Inadequate arguments for business as usual

Alarmingly, a September 2021 analysis conducted by the UN found that global carbon dioxide emissions continue to follow an upward trend. This means that the extraction and burning of fossil fuels is not slowing - and our banks are not helping. When all else fails, a bank may be forced to admit that it's financing fossil fuels, but even then, this activity is often explained to sound sustainable.

For example, ANZ (one of Australia’s 'big four' banks) released a Climate Change Statement in November 2020. Unlike the other examples here, this information is not a front-and-centre feature of ANZ's website, but these inadequate arguments are rife and deserve to be highlighted:

ANZ's Climate Change Statement [source]

On one hand, ANZ's Climate Change Statement flags the bank's support for ending the fossil fuels era:

- "…the transition [to net zero emissions by 2050] will require more than US$1.5 trillion to be invested annually in clean energy and efficient infrastructure. Bank lending will be the most significant source of funding for that investment. This is why the decisions we make today – and tomorrow – about who and what we lend to are so important."

On the other hand, ANZ's statement defends its support for continuing the fossil fuels era:

- "We understand that some of our stakeholders view our financing of fossil fuel industries as in conflict with our stated positioning of the need to reduce emissions. Today, around 56% of Australia’s electricity comes from coal-fired power stations. Many communities, particularly those in regional areas, are reliant on the coal industry for employment."

It is, of course, difficult to argue against more jobs for Australians, which is probably how ANZ justifies more financing for companies expanding fossil fuels than any other Australian bank in 2020.

Within Australia's broader climate context however, those job losses are a comparatively small problem. According to the Victorian government's Climate Projections 2019 publication, there is "high confidence" that by the 2050s, in a high-emissions scenario, the Greater Melbourne area (where ANZ is headquartered) will experience a median average of 7.7 extra days per year on which the Forest Fire Danger Index will be at its highest levels. If ANZ continues financing fossil fuel expansion, Australia will lose a lot more than coal industry jobs.

Clarke JM, Grose M, Thatcher M, Round V & Heady C. 2019. Greater Melbourne Climate Projections 2019. CSIRO, Melbourne Australia

ANZ's statement uses phrases such as "anticipate and adjust to change over time", which depicts a non-urgent strategy that's completely at odds with the science expressed in the latest IPCC report on climate change. ANZ is downplaying the urgency and seriousness of an issue that doesn't fit in its conservative economic framework. The phrasing is soothing and therefore alluring, but it's also misleading and inadequate.

Style... and substance

Just like JP Morgan Chase, Triodos Bank UK's "about us" section swims in the murky waters of sustainability. Furthermore, the phrase "we only finance companies that focus on people, the environment or culture" is also over-simplistic and vague. Is this greenwashing? If it masks financing activities that enable the harm of people, the environment or culture, then yes, but Triodos UK provides strong evidence to the contrary.

Triodos's Website [source]

Elsewhere on the website is a tool to browse every organisation that Triodos UK lends to. While banks such as NatWest make it very difficult to establish what they use their customers' money for, Triodos is actively supplying this information publicly. It's almost like they have nothing to hide. It is clearly stated that Triodos UK funds the environment, culture, and social sectors only. Furthermore, the UK's long-established, not-for-profit consumer guide Which? just assessed Triodos' savings accounts to be the UK's most sustainable.

Triodos's Website [source]

Facts grounded in evidence

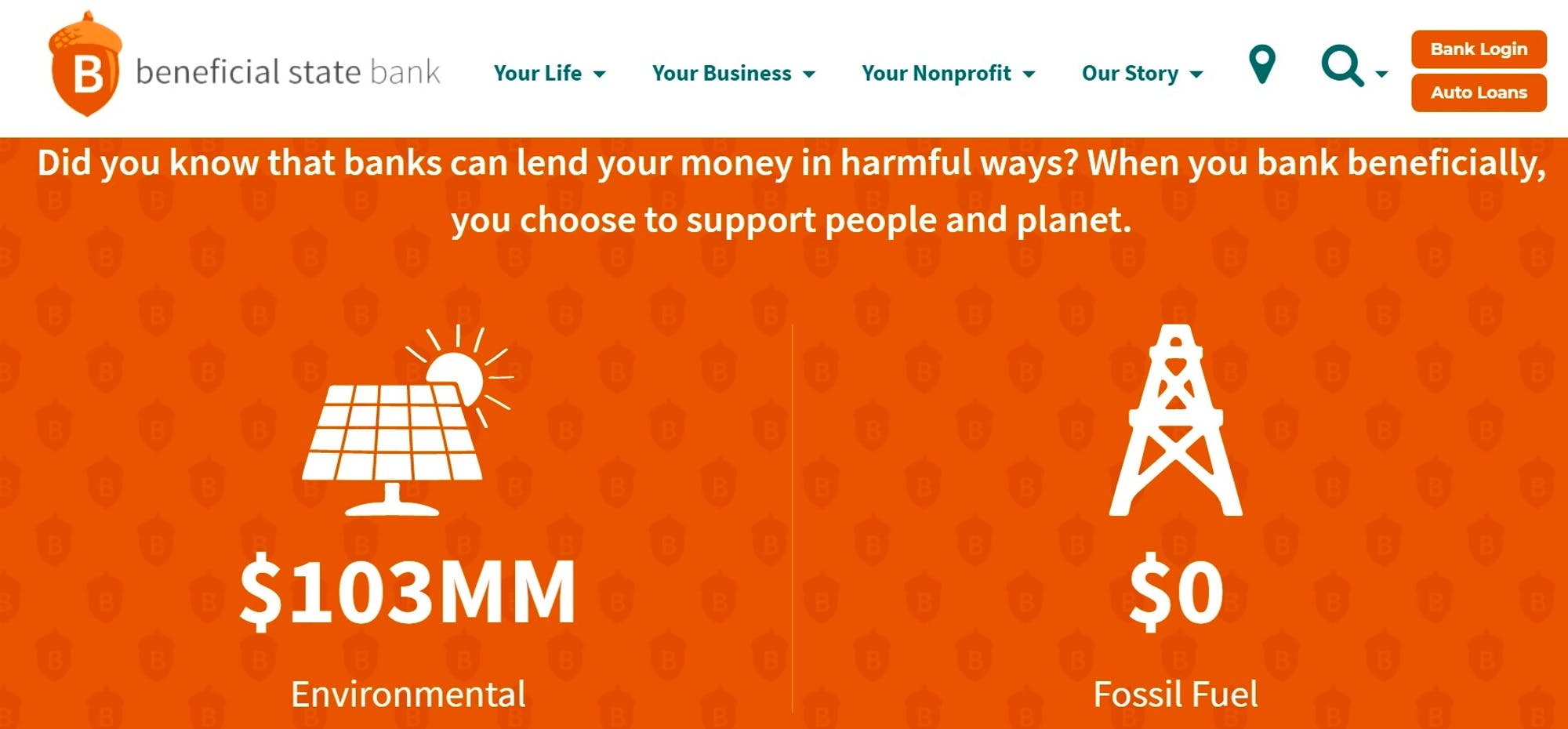

A bank that tells you what it is using your money for? That's a wonderful thing. But shouldn't it just be a normal thing? Unfortunately, it isn't. This makes Beneficial State Bank's homepage striking, because the first thing you'll see are statements about what the bank will and won't use your money for.

Beneficial State Bank's Website [source]

Bank.Green's mission is to move money away from fossil fuels, but it's usually difficult to get a bank to tell us if it's financing that. Not so with Beneficial State Bank...

Beneficial State Bank's Website [source]

...it's right here on the homepage. Beneficial State Bank uses $0 USD of its customers' money to finance fossil fuels. As with HSBC, if Beneficial State Bank is making false claims here, it would be setting itself up for unnecessary trouble. Greenwashing isn't about lying though, it's about choosing to talk about good work that is entirely outweighed by (mostly, hidden) bad work.

To combat greenwashing in the banking sector, we have to uncover the bad work. In the case of Beneficial State Bank, one of the resources we check is B Corp. This Pennsylvania-based, non-profit organization assesses the overall positive impact of any company, free of charge. It does this by looking at factors such as workers, suppliers, community, and the environment. In order to be a "certified B Corp", a company needs to score at least 80 points out of 200; Beneficial State Bank has a current Overall B Impact Score of 158.9. Therefore Beneficial appears to be transmitting more complete - and less misleading - messages than HSBC, JP Morgan Chase, and ANZ.

Paddle out of the greenwash

Even though this article tries to provide examples, any attempt to categorize a bank's messaging as either "100% truthful" or "100% lies" is tough. That's why our Take Action section includes advice on how to start a conversation with your bank, because we want to empower you to make up your own mind. Moreover, just by talking to your bank, you're creating pressure for change. That change is also the responsibility of governments and regulatory boards, but when concerned customers speak up, we create the space in which change is possible.

Want to know more about how Bank.Green ranks the world's banks? Read How do you assign bank ratings? in our FAQ section.

Start to Bank Green Today

Banks live and die on their reputations. Mass movements of money to fossil-free competitors puts those reputations at grave risk. By moving your money to a sustainable financial institution, you will:

Send a message to your bank that it must defund fossil fuels

Join a fast-growing movement of consumers standing up for their future

Take a critical climate action with profound effects